Guidelines for Grant of Reward to Informants leading to Recovery of Irrecoverable Taxes, 2015

Instruction No.07/2015

F .No.385/21/2015-IT(B)

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

North Block, New Delhi

26th August, 2015

To

All the Pr. CCsIT/ CCsIT/Pr. DGsIT/DGsIT

Subject: Guidelines for Grant of Reward to Informants leading to Recovery of Irrecoverable Taxes, 2015.

Madam/Sir,

In supercession of the guidelines for Grant of Reward to Informants, 2007, I am directed to say that the following guidelines will regulate the grant of reward to informants leading to recovery of taxes of tax defaulters whose names have been published in the public domain under section 287 of the Income-tax Act, 1961.

1. Short title

These guidelines may be called the 'Guidelines for Grant of Rewards to Informants leading to Recovery of Irrecoverable Taxes 2015'.

2. Application of Guidelines

(i) These guidelines will regulate the grant and payment of reward to informants who provide specific and credible information of the whereabouts/assets of persons, on or after 31.03.2015, which results in the collection of taxes, penalties, interest or other amounts (hereinafter “tax") already levied under the Income Tax Act, 1961 and the Wealth Tax Act, 1957. Grant and payment of reward for information provided before 31.03.2015 will continue to be regulated by 'Guidelines for Grant of Rewards to Informants 2007'.

(ii) These guidelines will be applicable if the jurisdictional Pr. Chief Commissioner/Chief Commissioner is satisfied that the tax could not be recovered despite all possible efforts having been made by the Department to trace the defaulter assessee or his assets and the information provided by the informant has resulted in recovery of tax.

3. Reward Amount

i. Individuals will be eligible for rewards based on the tax collected as a result of any administrative or judicial action resulting from the information provided. The quantum of tax collected will be determined only after all assessments have become final and no appeal/revision/other litigation is pending.

ii. The reward would not exceed 10% of the tax, recovery of which is directly attributable to the information/documents supplied by the informant, subject to a ceiling of Rs. 15 lakh. The full Board may relax the ceiling of Rs. 15 lacs on the basis of recommendation of the Committee mentioned in paragraph 4 below.

iii. Reward should be processed and granted in respect of recoveries directly attributable to the information furnished by the informant which was not in the knowledge of the department. Any proposal to this effect must be mooted after recoveries have been made of irrecoverable taxes and there is no further litigation. Reward will be only with reference to taxes recovered in the case of a taxpayer about whom information is given.

iv. Reward in accordance with these guidelines is discretionary and will be in the nature of ex-gratia payment which, subject to these guidelines, will be granted in the absolute discretion of the authority competent to grant rewards. No representation or petition against any decision regarding grant of rewards will be entertained from either the informant or any person on his behalf and the outcome of the claim cannot be disputed in Court.

v. The reward under these guidelines is in the nature of ex-gratia payments and accordingly, no assignment thereof made by the informants will be recognized. The authority competent to grant rewards may however; grant reward to heirs or nominees of an informant of an amount not exceeding the amount that would have been payable to the informant, had he not died.

4. Authorities Competent to Grant Reward

The authority competent to grant reward will be the Pr. Chief Commissioner of Income Tax/ Chief Commissioner of Income Tax in whose charge the arrears, from which recovery is made, are recorded .However, where the amount of reward in any given case exceeds Rs. 1,00,000/-, the same should be approved by a Committee of three officers comprising the Pr.Chief Commissioner (Pr.CCIT) of the region as Chief Commissioner concerned and one other Chief Commissioner of Income Tax nominated by the Pr. CCIT. In case Pr. Chief Commissioner of Income Tax is also the Chief Commissioner of Income tax concerned, he/she shall nominate one more Chief Commissioner as member of the committee.

5. Informants for the purpose of the guidelines:

i. A person will be considered to be an informant eligible for reward in accordance with these guidelines if he furnishes specific information in relation to assets/untraceable assessees concerning irrecoverable taxes. However, the claim of reward shall be confined to cases where action is actually taken in pursuance of the information. The information provided must be supported by facts/documents and should not be speculative, vague, of general nature or an "educated guess".

ii. In the cases where the documents or supporting evidence are known to the informant but are not in his possession, the informant should describe these documents and identify their location to the best of his ability.

iii. The information can be submitted to the j urisdicational Pr.CCIT/CCIT/Pr.CIT of the assessee as mentioned vide publication of his name in public domain or in the office of any other Pr.CCIT/CCIT to the officers designated as nodal officers( not below the rank of Addl/JtCIT) for receiving the information. Information received by any other Pr.CCIT/CCIT will be forwarded within 15 days to the jurisdictional Pr.CCIT/CCIT.

iv. The jurisdictional Pr.CIT will be act as the Nodal Authority to examine and decide the nature of actionable information as provided in Annexure-A.

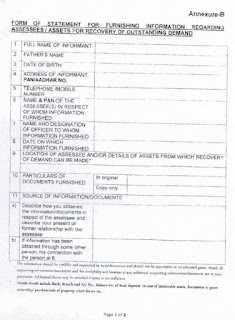

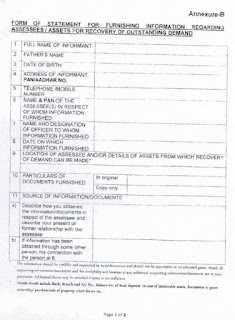

6. Statement of informant

Where any information or evidence is furnished by any person in the expectation of a reward, he will be required to furnish a written statement as per Annexure - B to these guidelines. Such a statement should be signed by the informant in the presence of the Nodal Officer, to whom the information is furnished. Where any information is received by post intimating that the information is given with a view to claim reward, the informant should appear before and sign the written statement in the presence of such authority. The original statement in all cases should be kept in the custody of the jurisdictional Pr. CIT No reward shall be admissible if the informant refuses to give the written statement as referred to above.

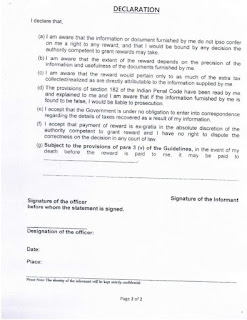

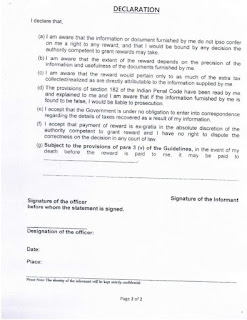

7. Written undertaking of the informant

At the time an informant furnishes, in the expectation of a reward, any information or documents, an undertaking should be taken from him to the effect:

a) That he is aware that the information or documents furnished by him do not ipso facto confer on him the right to any reward and that he would be bound by the decision of the competent authority in this regard.

b) That he is aware that the extent of reward depends on the precision of the information and usefulness of the documents furnished by him;

c) That the reward would pertain only to as much of the taxes recovered/realized as are directly attributable to the information supplied by him;

d) That the provisions of section 182 of the Indian Penal Code have been read by him or explained to him and he is aware that if the information furnished by him is found to be false he would be liable to prosecution;

e) That he accepts that the Government is under no obligation to enter into any correspondence regarding the details of any taxes realized as a result of his information and;

f) That he accepts that payment of reward is ex-gratia in the absolute discretion of the authority competent to grant rewards and he has no right to dispute the correctness of the decision in any court of law.

8. Circumstances to be kept in view in determining the amount of reward In determining the reward amount, the authority competent to grant the reward will keep the following in view:

a) The accuracy of the information given by the informant.

b) The extent and nature of the help rendered by the informant.

c) The risk and trouble undertaken and the expense and odium incurred by the informant in securing and furnishing the information and documents.

d) The quantum of work involved in utilizing the information furnished and the facility with which such tax could be recovered as a result of the information.

6) The quantum of tax recovered which is directly attributable to the information and documents supplied by the informant.

f) The quantum of reward already given in terms of Guidelines for Grant of Rewards to Informants, 2007 where the proceeding or action for levy of tax was originally initiated on the basis of information provided by the same informant.

9. Secrecy of the identity of the informant

The identity of the informant shall be kept secret if so desired by him by giving him a number. No information relating to informants or the rewards paid to them shall be disclosed to any authority except in accordance with any law for the time being in force.

10. Certificate from the Internal Audit Par

When the amount of reward is Rs] lakh or more, the Pr.CCIT or CCIT concerned shall, before the grant of reward, get the case checked and obtain a certificate from the concerned Pr.CIT regarding the correctness of the taxes recovered.

11. Prohibition of rewarding in certain cases

No reward shall be granted if-

i. The informant is a Government servant who furnishes information or evidence obtained by him in the course of his normal duties as a Government Servant.

Explanation: A person employed as an employee by the Central or any State or any Union Territory Government or a nationalized bank or any local authority or any public sector undertaking, corporation, body, corporate or establishment, set up or owned by the Central Government or any State Government or any Union Territory Administration shall be deemed to be a Government Servant for the purposes of this paragraph; or

ii. The informant is required by law to disclose the information to the Department; or

iii. The informant has access to the information on the basis of a contract with the Government

iv. The Scheme should be confined to only cases where;

(a) assessee is not traceable,

(b) there are no/inadequate assets for recovery,

(c) self assessment tax is outstanding for more than 6 months,

(d) TDS has been deducted but not deposited for more than 6 months.

and their names have been published in public domain under section 287 of the Income Tax Act, 1961.

12. Maintenance of record of each informant and not taking cognizance of Information furnished by certain informant.

The Authority competent to obtain information, evidence or documents from informant will maintain record of each informant, giving in brief his antecedents, the details of cases in which he has furnished information and the extent to which information has been found reliable. In case it is found that the antecedents of the informant, the nature of the information furnished by him in the past and his conduct justify ignoring the information, evidence and documents furnished by him, the case should be referred by such authority to the Pr. CCIT/CCIT concerned, and if approved by him, it would be open for such authority not to take cognizance of the information furnished by such an informant.

13. Drawing of the bill

The orders of the authority competent to grant reward in cases where such authority is himself competent to grant reward and in case in which the decision vests with the Committee referred to in paragraph 4 are applicable, sanction of the Committee referred to therein, will constitute sufficient authority for drawing the bill on the treasury against the sanctioned allocation.

14. Control and audit expenditure relating to rewards

The control and audit of the expenditure for reward will be governed by the instructions specifically issued for the purpose from time to time.

15. Hindi version shall follow.

(Sandeep Singh)

Under Secretary to the Government of India

Annexure-A

.

INTERNAL GUIDELINE TO DECIDE ACTIONABLE INFORMATION.

1. The information should be first hand information.

2. Information should be in written form clearly indicating:-

I. Movable assets from which recovery can be made.

i. Bank Name/ Branch.

ii. Account Number

iii. Amount shown as balance.

iv. Proof of share/debentures & any other negotiable instrument.

II. Immovable Assets.

a. Undisclosed property, shops investment in real estate.

b. Probable inheritance by court decree or any other incident.

c. Proof of purchase or sale or ownership of property.

III. Investment in foreign Bank Accounts, Assets.

3. Necessary conditions for treating the information as actionable:

a) The information must be backed by proof.

b) It should be in writing.

c) The information must be authentic and not mere suspicion, conjectures or imaginary concept

d) The evidence must be visible and direct, actionable and not directed at realisation after liquidation, partition of firm/company etc.

e) information must not be known to the department. If at a later stage it is found that information was not unknown, reward will be denied.

|

| Annexure-B Page1 |

|

| Annexure B Page-2 |

Source: http://irsofficersonline.gov.in/Documents/OfficalCommunique/193201533215.pdf

Read more: http://www.staffnews.in/2015/09/guidelines-for-grant-of-reward-to.html#ixzz3kpxTQgxF

Under Creative Commons License: Attribution Share Alike

Follow us: @karnmk on Twitter | cgenews on Facebook